Table of Content

Home loan EMI calculator helps you to calculate your home loan EMI based on the loan amount, the tenure for which you are taking a loan and the interest rate that is levied on the amount that is borrowed. Getting an education loan is an easy way to finance your dreams. A student loan can help you get into the university of your choice.

Borrowers should prepare for more increases in loan interest rates as experts predict that the central bank will raise policy rates in the future. A borrower can choose to extend the loan's term if they are unable to make the increased EMI payments. Kotak Mahindra Bank provides personal loans from Rs. 50,000 to Rs. 25 lakhs at attractive interest rates (as low as 10.99 % per annum) and a repayment tenure ranging from 1 year to 5 years. Moreover, by using Kotak Mahindra Bank’spersonal loan EMI calculator online,you can find the highest EMI for the loan. That way, you can ensure you repay the loan without any hassles. So, before you avail a personal loan, make sure that you use the personal loan calculator to check the expected EMIs.

Home Loan Prepayment EMI Calculator

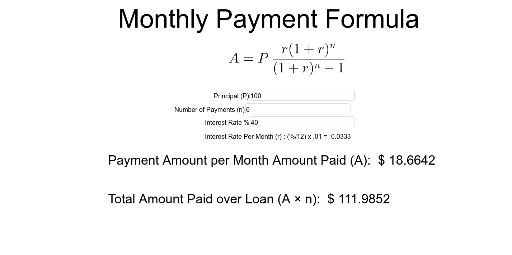

An EMI is a monthly payment paid by the borrower to the creditor. It can be calculated using a housing loan EMI calculator. Inputting the required values will help you find out the accurate amount of EMI.

Bankrate's calculator also estimates property taxes, homeowners insurance and homeowners association fees. A hike in the MCLR rate by 10-basis points will change the loan interest rates of HDFC bank for both new and existing borrowers from 7 September 2022. This will be applicable for home loans, vehicle loans, or any other loans equated to monthly installments. As per the revised rate, there has been an increase of 8.2% in the bank’s one-year MCLR, and it also shot up by 7.9% overnight. The MCLR will be 7.90%, 7.95%, and 8.05% for the one-month, three months, and six months tenor, respectively.

Home Loan Calculator Features and Benefits

Home Loan eligibility is the amount of Home Loan that a customer is eligible to get basis the details provided. Your dream home is now within your reach with ICICI Bank Home Loans. Your Home Loan Eligibility can be further enhanced by including income of the co-applicant of your Home Loan. For example if your loan amount is ₹ 5 lakh for 2 years at 12% p.a., the formula to calculate EMI is as follows. Investments in securities market are subject to market risks, read all the related documents carefully before investing.

Your rate will vary depending on whether you’re buying or refinancing. What is part disbursement or subsequent disbursement of home loan? HDFC Home Loans disburses the funds for a property which is under construction in instalments. These disbursements are based on the progress of the construction and are called subsequent or part disbursement. You can maximise the loan amount by adding a co-applicant.

What are the Benefits of Home Loan EMI Calculator?

As the largest platform for buyers and sellers of property to connect in a transparent manner, Magicbricks has an active base of over 15 lakh property listings. As long as your home loan agreement allows, you can make full or partial prepayment on your home loan. When you repay your loan fully or partially ahead of the scheduled tenure, it’s called prepayment of home loan. Home loan prepayment works for you when you are looking to reduce your debt burden. Kotak Mahindra Bank’s personal loan EMI calculator is completely free of cost.

Make an informed decision with Kotak Bank’s Home Loan EMI Calculator. A user-friendly tool, it helps you with crucial details like home loan amount, home loan interest rates, home loan tenure and a lot more. Equated Monthly Instalment is a fixed amount paid by a borrower to a lender on a select date every month for the tenure of the loan. Home Loan EMI becomes a very important factor in deciding your home loan. It is the repayment of the principal amount as well as the interest on your outstanding home loan amount as per the amortization schedule.

✔ Investigate the details of the Home Loan as well as the property you are looking to acquire. Kotak home finance is quick and easy, all thanks to our minimal documentation. Pay ANY mobile number registered against ANY payment app.

Any home loan borrower is eligible to opt for the prepayment facility. However, you must check with the bank if the prepayment facility is provided when you avail the home loan. That’s a reduction of Rs.900 every month (5% EMI savings). You can also choose to keep your EMIs at Rs.17,995 and reduce your tenure. Once you have figured out your eligibility for a home loan, you can check home loan interest rate for all banks and apply for the one that suits you best.

That’s why, many home buyers choose to borrow a house loan. In this case, let us assume that your rate of interest is 16% per annum with a repayment term of 8 months. The easiest way to find out your EMI is to use the Money View Personal Loan EMI Calculator.

The calculator will then instantly calculate the EMI, total payable amount as well as the interest amount. While shopping for any loan, it’s a good idea to use a loan calculator. A calculator can help you narrow your search for a home or car by showing you how much you can afford to pay each month. It can help you compare loan costs and see how differences in interest rates can affect your payments, especially with mortgages. The right loan calculator will show you the total cost of a loan, expressed as the annual percentage rate, or APR. Loan calculators can answer a lot of questions and help you make good financial decisions.

No comments:

Post a Comment